Our Blog

Insights to Grow Your Financial Confidence

Stay informed with expert advice and actionable tips on financial planning, investment strategies, and tax planning. Our blog is designed to help you make smarter decisions for a secure financial future.

Women: Moving Forward Financially After the Loss of a Spouse

The loss of a spouse can be a devastating, life-changing event. Due to longer life expectancies, women are more likely to face this situation.Becoming a widow at any age can be one of the most...

Read more

Adjusting to Life Financially after a Divorce

There's no doubt about it — going through a divorce can be an emotionally trying time. Ironing out a divorce settlement, attending various court hearings, and dealing with competing attorneys can...

Read more

Death of a Family Member Checklist

Losing a loved one can be a difficult experience. Yet, during this time, you must complete a variety of tasks and make important financial decisions. You may need to make final arrangements, notify...

Read more

Charitable Giving

Charitable giving can play an important role in many estate plans. Philanthropy cannot only give you great personal satisfaction, it can also give you a current income tax deduction, let you avoid...

Read more

Women and Estate Planning Basics

When it comes to estate planning, women have unique concerns. The fact is that women live an average of 5.3 years longer than men.* That's important because it means there's a greater chance that...

Read more

Estate Planning and Income Tax Basis

Income tax basis can be an important factor in deciding whether to make gifts during your lifetime or transfer property at your death. This is because the income tax basis for the person receiving...

Read more

Reaching Retirement: Now What?

You've worked hard your whole life anticipating the day you could finally retire. Congratulations — that day has arrived! But with it comes the realization that you'll need to carefully manage your...

Read more

Deciding When to Retire: When Timing Becomes Critical

Deciding when to retire may not be one decision but a series of decisions and calculations. For example, you'll need to estimate not only your anticipated expenses but also what sources of...

Read more

A Retirement Income Roadmap for Women

More women are working and taking charge of their own retirement planning than ever before. What does retirement mean to you? Do you dream of traveling? Pursuing a hobby? Volunteering your time, or...

Read more

Working During Retirement

Planning on working during retirement? If so, you're not alone. An increasing number of employees nearing retirement plan to work at least some period of time during their retirement years.Why work...

Read more

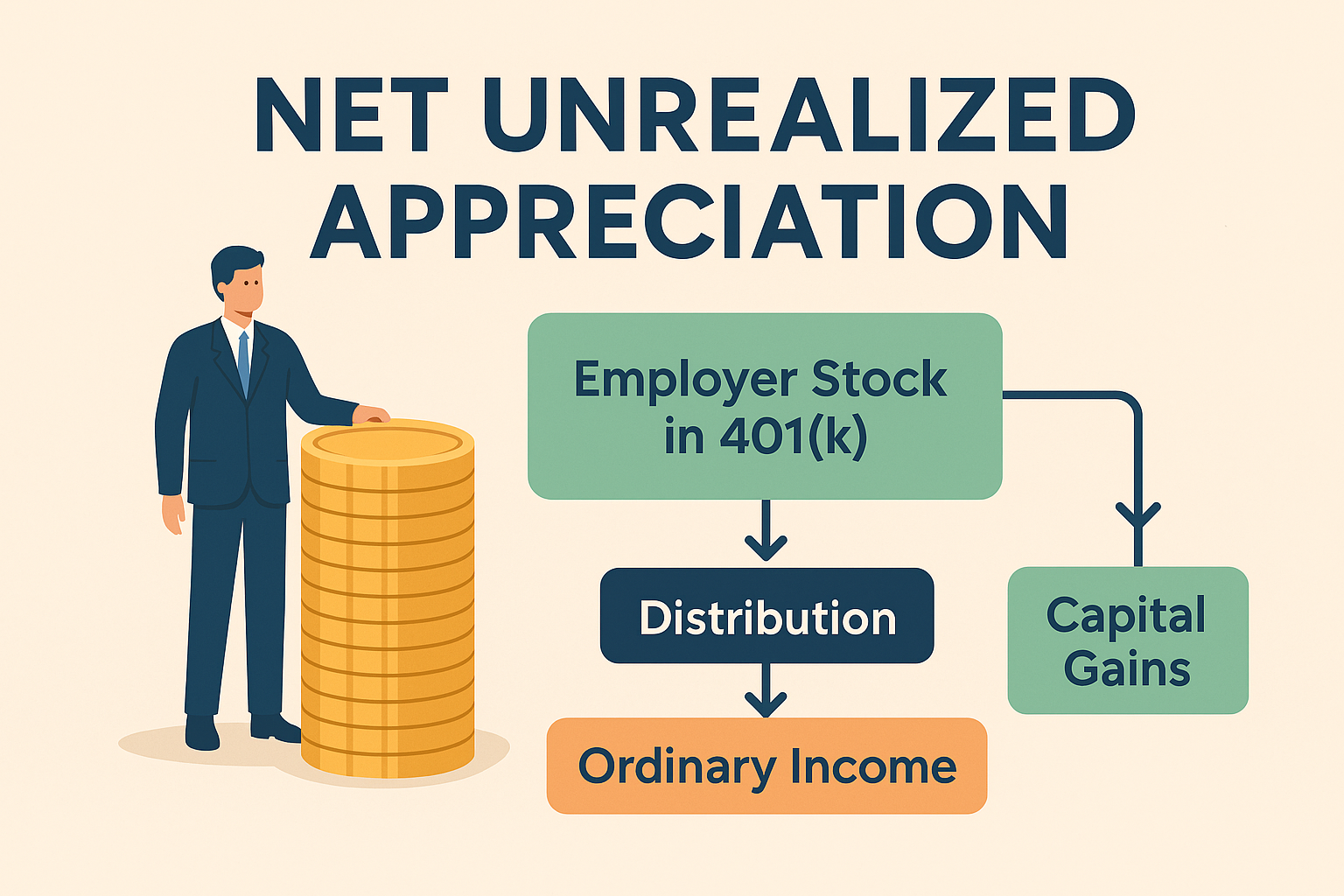

Net Unrealized Appreciation: The Untold Story

If you participate in a 401(k), employee stock ownership plan, or other qualified retirement plan that lets you invest in your employer's stock, you need to know about net unrealized appreciation —...

Read more

Missouri Tax Benefits for Retirees: What You Need to Know in 2025

Retirement should be a time to relax—not worry about taxes. Fortunately, Missouri offers several tax benefits that can help retirees keep more of their hard-earned income. From Social Security...

Read more

Take Action Before December 31st: The Missouri Senior Property Tax Freeze

Understanding Missouri’s Senior Property Tax Freeze: What You Need to KnowMissouri seniors have a new tool to help manage rising property taxes: the Senior Property Tax Freeze. This program,...

Read more

Handling Market Volatility

Conventional wisdom says that what goes up must come down. But even if you view market volatility as a normal occurrence, it can be tough to handle when your money is at stake. Though there's no...

Read more

Understanding the Net Investment Income Tax

If your income hits a certain level, you may face an additional wrinkle in calculating your taxes: the net investment income tax (also referred to as the unearned income Medicare contribution tax)....

Read more

4 Smart Financial Moves to Make Before Year-End

As the end of the year approaches, it's the perfect time to take charge of your financial planning. While financial tasks can seem overwhelming, empowering yourself with proactive decisions can...

Read more

Smart Ways to Maximize IRA and HSA Contributions

With Tax Day fast approaching, now is the perfect time to review strategies that can help reduce your tax burden while reinforcing your savings. Among the most effective, yet often overlooked tools...

Read more

Year-End Tax Planning Basics

The window of opportunity for many tax-saving moves closes on December 31, so it's important to evaluate your tax situation now, while there's still time to affect your bottom line for the 2025 tax...

Read more

2026 IRA and Retirement Plan Limits

Many IRA and retirement plan limits are indexed for inflation each year. Several of these key numbers have increased once again for 2026. How much can you save in an IRA?The maximum amount you can...

Read more

Navigating November's Financial Markets

Last month presented a seemingly calm facade for the U.S. financial markets, yet it was brimming with complexity beneath the surface. As markets edged near record highs, enthusiasm for artificial...

Read more

Estate Planning Essentials for Kansas Residents

At Next Bloom Wealth, we emphasize the importance of maintaining up-to-date estate planning documents and beneficiary designations. Without proper planning, state intestacy laws will dictate asset...

Read more

Estate Planning Essentials for Missouri Residents

At Next Bloom Wealth, we emphasize the importance of maintaining up-to-date estate planning documents and beneficiary designations. Without proper planning, state intestacy laws will dictate asset...

Read more

New Senior Deduction Explained

Beginning in 2025, seniors can take advantage of a new $6,000 tax deduction that may help them cover the rising costs of housing, health care, and daily living by potentially allowing more of their...

Read more

Fall Into Smarter Tax Planning With Tax-Loss Harvesting

As the leaves change and the year winds down, there's a crisp chill in the air that invites reflection. It's a time for cozy sweaters, warm mugs, and maybe a brisk walk through the falling foliage....

Read more

Mandatory Roth Catch-Up Contributions Begin in 2026

For nearly a quarter century, employers have been able to offer their retirement savings plan participants age 50 and older a valuable opportunity — the chance to make additional catch-up...

Read more

Why Did the Federal Government Shut Down? And What Happens Now?

The federal government officially shut down many of its operations at 12:01 a.m. on October 1, 2025.1 This is the 15th government shutdown since 1980. Most were short, lasting one to three days....

Read more

National Financial Planning Month: Key Insights for HNW Clients

Embrace the Opportunity of National Financial Planning MonthOctober is National Financial Planning Month, a time to reflect on the unique complexities and responsibilities of managing significant...

Read more

Fall Financial Practices for a Strong Year-End

The crisp air of fall signals the approach of the holiday season—a time that can often feel overwhelming, especially in terms of finances. Yet, this season also brings a unique opportunity to pause...

Read more

The OBBBA and Its Impact on Seniors

Legislative changes, especially those affecting finances and healthcare, can be daunting. For seniors, staying informed about these shifts is crucial. The newly signed One Big Beautiful Bill Act...

Read more

Back-to-School Financial Planning Made Easy

Embracing the Back-to-School Financial ShiftThe back-to-school season is upon us, and with it comes a whirlwind of activity. Whether you're managing tuition, adjusting savings strategies, or...

Read more

Financial Market Highlights: Second Quarter 2025

Stamina Amidst Monetary UncertaintyThe U.S. economy has shown remarkable resilience in the first half of 2025 despite ongoing uncertainties surrounding monetary and fiscal policies. While the...

Read more

June Financial Markets Overview: Key Highlights and Insights

U.S. Stock Market PeaksJune witnessed remarkable growth in major U.S. stock indexes, piquing investor interest as markets shifted back to a risk-on stance. Both the S&P 500 and Nasdaq 100 soared to...

Read more

Key Steps to Take After You File Your Tax Return

Phew, the relief of filing your taxes! But wait, the tax process isn't necessarily over once you've submitted your return. Taking a few extra steps can ensure a smooth post-filing experience and...

Read more

Understanding the Social Security Fairness Act Changes

The Social Security Fairness Act: A New Era for RetireesThe Social Security Fairness Act, signed into law on January 5, 2025, marks a significant shift in retiree benefits, particularly for public...

Read more

Understanding Risk Tolerance for Smarter Investments

When it comes to managing investments, understanding your risk tolerance is paramount. This critical aspect involves balancing opportunities with potential losses and acknowledging the emotional...

Read more

January 2025: Financial Wellness Month to Boost Your Finances

January 2025 marks Financial Wellness Month—a time to take control of your financial health. With the start of the new year, there’s no better moment to reflect on personal financial goals and make...

Read more

Understanding the Rising Costs of Long-Term Care

Preparing Financially for Long-Term Care as We AgeAs we age, the necessity for long-term care becomes an increasingly probable reality. With the demographic of aging individuals growing, it's...

Read more

Financial Buzz: November Markets & Economic Insights

As November 2024 unfolded, the financial landscape navigated through significant developments. With the presidential election wrapping up and market sentiment reaching new heights, November proved...

Read more

Estate Tax Exemption Changes in 2026: Prepare Now

Understanding the Estate Tax Exemption Sunsetting in 2026The Tax Cuts and Jobs Act (TCJA) of 2017 brought significant changes to the federal estate tax laws. However, these changes are temporary,...

Read more

A Comprehensive Guide to Tax Income Brackets for Different Filers

When it comes to understanding your tax obligations, knowing which income bracket you fall into can make a significant difference in your financial planning. Tax income brackets are ranges of...

Read more

Reassessing the $1 Million Retirement Savings Goal

Reassessing the $1 Million Retirement Savings GoalFor many, accumulating $1 million for retirement signifies financial security and preparedness. This long-held benchmark has been viewed as a...

Read more

What to Know: New 529 to Roth Transfer in 2024

The new rule that allows 529 plan beneficiaries to transfer funds to a Roth IRA starting in 2024 is a significant development for families. This change can greatly benefit those planning for both...

Read more

How to Effectively Interview a Financial Advisor

Interviewing a financial advisor is a critical step in finding the right professional to manage your financial well-being. Financial advisors often have various titles like wealth advisor or...

Read more

View more