At Next Bloom Wealth, we emphasize the importance of maintaining up-to-date estate planning documents and beneficiary designations. Without proper planning, state intestacy laws will dictate asset distribution, which may lead to unintended outcomes.

Many assets transfer by account title or beneficiary designation rather than through probate. In Kansas, for example, IRAs, brokerage accounts, vehicles, and homes can pass directly to named beneficiaries. For guidance on how your assets will transfer, contact Alex & Ashley for a consultation.

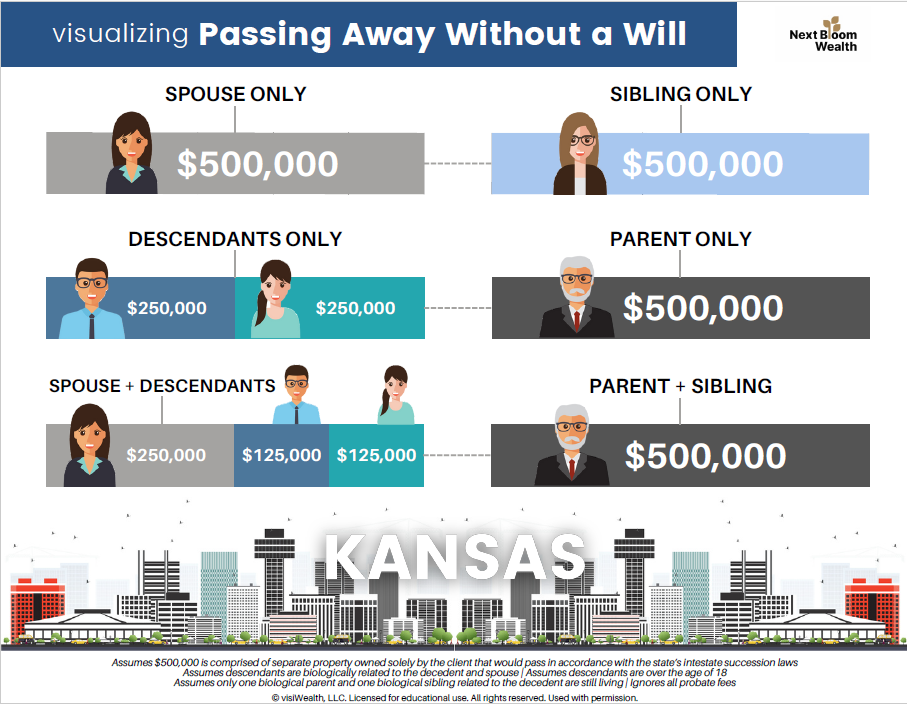

If you reside in Kansas, review the Passing Away Without a Will visual chart. Each scenario assumes $500,000 of separate property owned solely by the decedent and distributed under Kansas intestate succession laws:

- Spouse Only: Spouse inherits everything ($500,000).

- Descendants Only: Descendants inherit everything ($500,000 total; $250,000 each).

- Spouse and Descendants: Spouse receives half ($250,000); each descendant receives $125,000.

- Sibling Only: Sibling inherits everything ($500,000).

- Parent Only: Parent inherits everything ($500,000).

- Parent and Sibling: Parent inherits everything ($500,000).

These examples exclude probate and administrative costs and assume one biological parent, one sibling, and adult biological descendants. For details, see Kansas Statutes §§59-501 to 59-514